For months and years, the discussion about cloud and digital sovereignty has been dominated by absolutes. It was framed as a black-and-white choice. Either you are sovereign, or you are not. Either you trust hyperscalers, or you don’t. Either you build everything yourself, or you hand it all over. But over the past two years, organizations, governments, and even the vendors themselves have started to recognize that this way of thinking doesn’t reflect reality. Sovereignty is seen as a spectrum now.

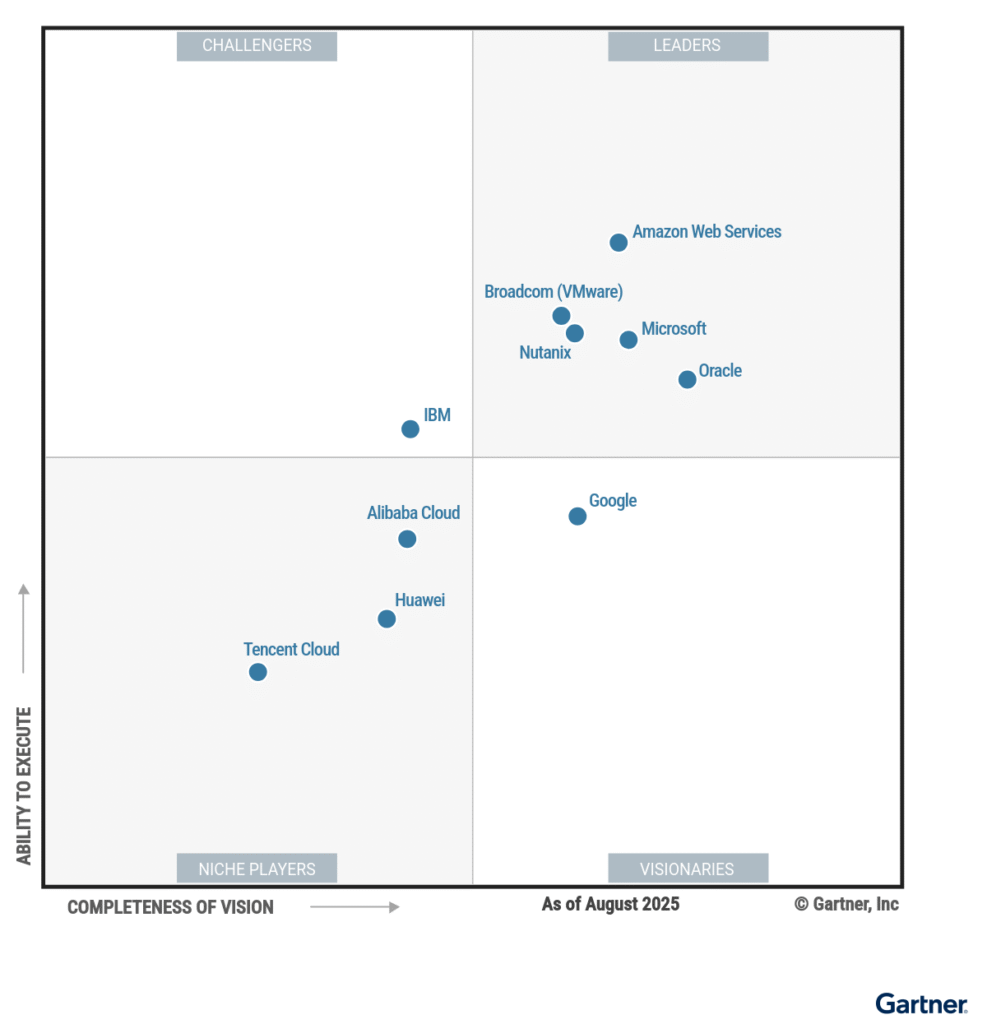

When I look at the latest Gartner Magic Quadrant (MQ) for Distributed Hybrid Infrastructure (DHI), this shift becomes even more visible. In the leader’s quadrant, we find AWS, Microsoft, Oracle, Broadcom (VMware), and Nutanix. Each of them is positioned differently, but they all share one thing in common. They now operate somewhere along this sovereignty spectrum. Some of them are “fully” sovereign and some of them are dependent. The truth lies in between, and it is about how much control you want to retain versus how much you are willing to outsource. But it’s also possible to have multiple vendors and solutions co-existing.

The Bandwidth of Sovereignty

To make this shift more tangible, think of sovereignty as a bandwidth rather than a single point. On the far left, you give up almost all control and rely fully on global hyperscalers, following their rules, jurisdictions, and technical standards. On the far right, you own and operate everything in your data center, with full control but also full responsibility. Most organizations today are somewhere in between (using a mix of different vendors and clouds).

This bandwidth allows us to rate the leaders in the MQ not as sovereign or non-sovereign, but according to where they sit on the spectrum:

-

AWS stretches furthest toward global reach and scalability. They are still in the process of building a sovereign cloud, and until that becomes reality, none of their extensions (Outposts, Wavelength, Local Zones) can truly be seen as sovereign (please correct me if I am wrong). Their new Dedicated Local Zones bring infrastructure closer, but AWS continues to run the show. Meaning sovereignty is framed through compliance, not operational autonomy.

-

Microsoft sits closer to the middle. With Microsoft’s Sovereign Cloud initiatives in Europe, they acknowledge the political and regulatory reality. Customers gain some control over data residency and compliance, but the operational steering remains with Microsoft (except for their “Sovereign Private Cloud” offering, which consists of Azure Local + Microsoft 365 Local).

-

Oracle has its EU Sovereign Cloud, which is already available today, and with offerings like OCI Dedicated Region and Alloy that push sovereignty closer to customers. Still, these don’t offer operational autonomy, as Oracle continues to manage much of the infrastructure. For full isolation, Oracle provides Oracle Cloud Isolated Region and the smaller Oracle Compute Cloud@Customer Isolated (C3I). These are unique in the hyperscaler landscape and move Oracle further to the right.

-

Broadcom (VMware) operates in a different zone of the spectrum. With VMware’s Cloud Foundation stack, customers can indeed build sovereign clouds with operational autonomy in their own data centers. This puts them further right than most hyperscalers. But Gartner and recent market realities also show that dependency risks are not exclusive to AWS or Azure. VMware customers face uncertainty tied to Broadcom’s licensing models and strategic direction, which balances out their autonomy.

-

Google does not appear in the leader’s quadrant yet, but their Google Distributed Cloud (GDC) deserves mention. Gartner highlights how GDC is strategically advancing, winning sovereign cloud projects with governments and partners, and embedding AI capabilities on-premises. Their trajectory is promising, even if their current market standing hasn’t brought them into the top right yet.

-

Nutanix stands out by offering a comprehensive single product – the Nutanix Cloud Platform (NCP). Gartner underlines that NCP is particularly suited for sovereign workloads, hybrid infrastructure management, and edge multi-cloud deployments. Unlike most hyperscalers, Nutanix delivers one unified stack, including its “own hypervisor as a credible ESXi alternative”. That makes it possible to run a fully sovereign private cloud with operational autonomy, without sacrificing cloud-like agility and elasticity.

Why the Spectrum Matters

This sovereignty spectrum changes how CIOs and policymakers make decisions. Instead of asking “Am I sovereign or not?”, the real question becomes:

How far along the spectrum do I want to be and how much am I willing to compromise for flexibility, cost, or innovation?

It is no longer about right or wrong. Choosing AWS does not make you naive. Choosing Nutanix does not make you paranoid. Choosing Oracle does not make you old-fashioned. Choosing Microsoft doesn’t make you a criminal. Each decision reflects an organization’s position along the bandwidth, balancing risk, trust, cost, and control.

Where We Go From Here

The shift to this spectrum-based view has major consequences. Vendors will increasingly market not only their technology but also their place on the sovereignty bandwidth. Governments will stop asking for absolute sovereignty and instead demand clarity about where along the spectrum a solution sits. And organizations will begin to treat sovereignty not as a one-time decision but as a dynamic posture that can move left or right over time, depending on regulation, innovation, and geopolitical context.

The Gartner MQ shows that the leaders are already converging around this reality. The differentiation now lies in how transparent they are about it and how much choice they give their customers to slide along the spectrum. Sovereignty, in the end, is not a fixed state. It is a journey.